- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Middle East & Africa Venture Capital Market: Current Analysis and Forecast (2025-2033)

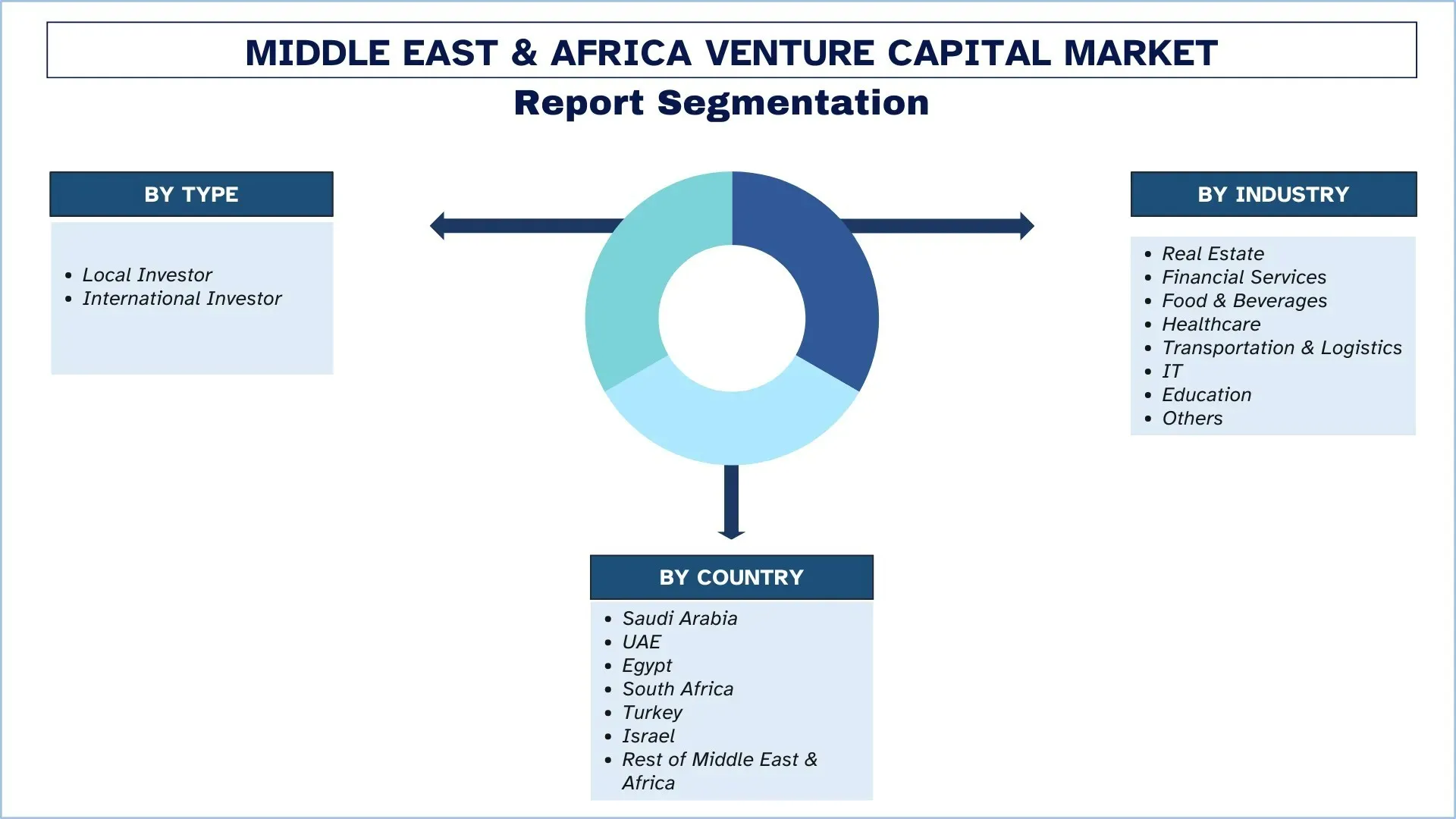

Emphasis By Type (Local Investor and International Investor), By Industry (Real Estate, Financial Services, Food & Beverages, Healthcare, Transportation & Logistics, IT, Education, and Others), By Country (Saudi Arabia, UAE, Egypt, South Africa, Turkey, Israel, and the Rest of Middle East & Africa)

Geography:

Last Updated:

Feb 2026

Middle East & Africa Venture Capital Market Size & Forecast

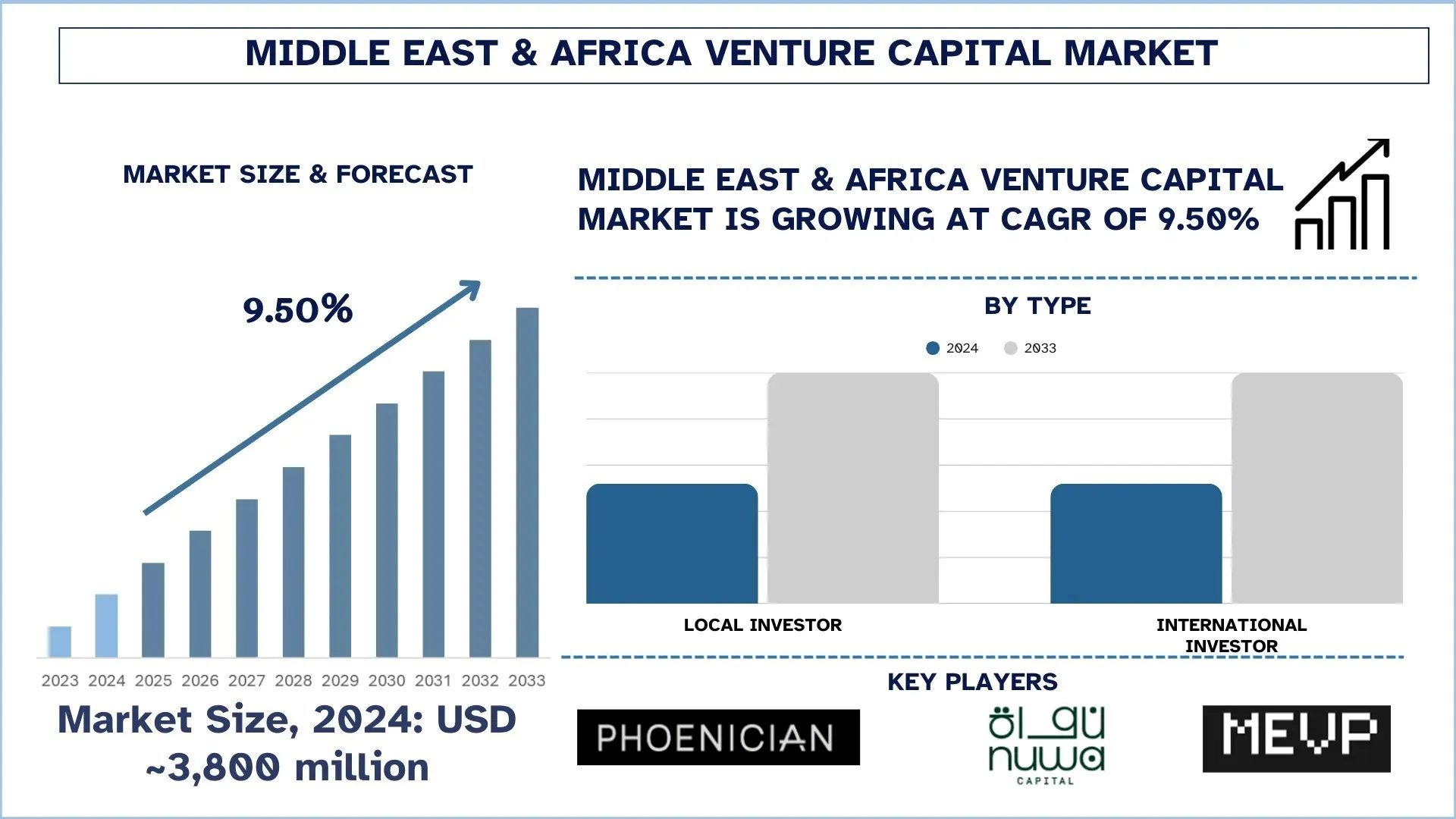

The Middle East & Africa Venture Capital Market was valued at USD 3,800 million in 2024 and is expected to grow at a strong CAGR of around 9.50% during the forecast period (2025- 2033F). State-backed capital & economic-diversification agendas, and Digital adoption and young, mobile-first consumers, promulgating the startup ecosystem, are the key factors contributing to the market rise.

Middle East & Africa Venture Capital Market Analysis

The Middle East & Africa venture capital market is becoming more of a hub-led, mature ecosystem. The Gulf growth is majorly related to national diversification agendas, with sovereign-linked investors anchoring funds, attracting global LPs, and speeding the scale-ups in the priority areas. The regulatory enhancements, computerized government services, and pro-business reforms are making it less painful to start a company and move capital around. In Africa, large consumer markets and innovation corridors have the most momentum and an expanding pipeline due to the growing fintech infrastructure, mobile-first distribution, and better startup support systems. Capital in both areas is becoming concentrated around platforms capable of going cross-border, such as payments, commerce enablement, logistics, health, and climate solutions, aided by the growth of local talent and operator networks.

Middle East & Africa Venture Capital Market Trends

This section discusses the key market trends that are influencing the various segments of the Middle East & Africa Venture Capital market, as found by our team of research experts.

Regulatory modernization in key hubs:

Policy is becoming a growth engine for venture capital through regulatory modernization in MEA in its key startup hubs. Governments are simplifying the process of forming a company, computerizing licensing, and enhancing shareholders, IP, and insolvency regulations in order to minimize execution risk. Specially designed fintech and payments regulations (usually accompanied by regulatory sandboxes) allow innovators to operate on a regulated footing, faster to market, and consumer friendly. Recent data-protection, e- signature, and cybersecurity regulations enhance confidence in transacting business across borders, and more explicit foreign-ownership, repatriation, and fund-structuring regulations are also appealing to international LPs. Venture visas, standardized ESOP tax, and simplified KYC/AML onboarding are also being brought on board by Hubs, and these initiatives enhance the movement of talent and acquisition of customers on a region-wide basis with a significant impact. Jurisdictional courts, expedited dispute resolution, and bankruptcy regimes of the present raise recoveries and allow second chances to founders. The net result is reduced uncertainty of compliance, enhanced capital mobility, and a more predictable scaling path, measures that transform diversification plans into regional-scale investable and scalable companies.

Key Market Segmentation:

This section provides an analysis of the key trends in each segment of the Middle East & Africa Venture Capital market report, along with forecasts at the country and regional levels for 2025-2033.

The Local Investors segment has shown promising growth in the Venture Capital Market.

According to type, the Middle East & Africa Venture Capital market is divided into local and international investors. Among these, the local investors have controlled a significant market share. This hegemony is indicative of the growing influence of sovereign wealth funds, government-sponsored vehicles, family offices, and regional corporates capable of injecting patient capital and successively organizing co-investment. On the ground sourcing, relationship-based access of founders, and better pegging of regulatory and operational reality across markets all favor local investors. They have a strong impact specifically in seed and early growth stages, where proximity, follow-on support, and network value are of greatest importance. International investors are also investing selectively, usually in syndicates or in later-stage rounds, and preferring to see clear regulatory avenues, strong unit economics, and plausible exit strategies.

The IT category held a significant share of the Middle East & Africa Venture Capital Market.

Based on industry, the Middle East & Africa Venture Capital market is segmented into Real Estate, Financial Services, Food & Beverages, Healthcare, Transportation & Logistics, IT, Education, and Others. In the Middle East and Africa, the IT segment is where venture capital activity is the most prevalent due to the high demand to scale to digital, cloud-based services, cybersecurity, and data-based business models. Next comes Financial Services with underpinning fast fintech adoption in the payments, lending, wealth tech, and embedded finance sectors. Healthcare is still advancing through the use of healthtech, diagnostics, and care delivery by the use of technology. Learning draws investment in educational technology that targets the development of skills, certification, and access to digital learning. Transportation & Logistics funding is spearheaded by last-mile delivery, mobility platforms, and supply-chain optimization. D2C brands and agrifood innovation are of interest in Food & Beverages, whereas in Real Estate, proptech and smart-building solutions are becoming popular in terms of activity. Others involve energy, climate-oriented projects, and new industrial technologies.

The UAE is expected to grow at a considerable rate during the forecast period.

The UAE venture capital market has become the most successful hub of the Middle East & Africa with robust government-driven innovation agendas, liberalizing regulation, and an increasingly institutionalized involvement. With infrastructure that is among the world's finest, free-zone hubs, and a growing stream of high-quality startups, Dubai and Abu Dhabi persist in magnetizing regional and global capital. The broad presence of fintech, SaaS, climate tech, logistics, and AI indicates the desire of the UAE to become a top digital economy. As the ticket size and the amount of follow-on funds increase along with the increase in cross-border deal flow, the UAE is slowly transforming into a robust, internationally integrated venture ecosystem. In 2025, Alaan, an expense management fintech based in the UAE, received USD 48 million in a series A funding by the Peak XV Partner in participation with Y Combinator, 468 Capital, Pioneer Fund, 885 Capital, alongside a group of other angel investors.

Middle East & Africa Venture Capital Industry Competitive Landscape:

The Middle East & Africa Venture Capital market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Middle East & Africa Venture Capital Companies

Some of the major players in the market are Wamda Capital, Middle East Venture Partners (MEVP), Global Ventures, Partech Partners, Beco Capital, Saudi Venture Capital Company (SVC), 500 Global, Phoenician Funds, Beyond Capital, and Nuwa Capital.

Middle East & Africa Venture Capital Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 9.50% |

Market size 2024 | USD 3,800 Million |

Country analysis | Saudi Arabia, UAE, Egypt, South Africa, Turkey, Israel, and the Rest of the Middle East & Africa |

Major contributing Country | Saudi Arabia is expected to dominate the market during the forecast period. |

Companies profiled | Wamda Capital, Middle East Venture Partners (MEVP), Global Ventures, Partech Partners, Beco Capital, Saudi Venture Capital Company (SVC), 500 Global, Phoenician Funds, Beyond Capital, and Nuwa Capital. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | by Type, by Industry, by Country |

Reasons to Buy the Middle East & Africa Venture Capital Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive Country-level analysis of the industry.

Customization Options:

The Middle East & Africa VENTURE CAPITAL market can further be customized as per requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs; hence, feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Middle East & Africa Venture Capital Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the Middle East & Africa Venture Capital market to assess its application in major countries. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Venture Capital value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed data triangulation techniques to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the Middle East & Africa Venture Capital market. We split the data into several segments and sub-segments by analyzing various parameters and trends, by Type, by Industry, and by country within the Middle East & Africa Venture Capital market.

The Main Objective of the Middle East & Africa Venture Capital Market Study

The study identifies current and future trends in the Middle East & African Venture Capital market, providing strategic insights for investors. It highlights Country-level market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

Market Size Analysis: Assess the current forecast and market size of the Middle East & Africa Venture Capital market and its segments in terms of value (USD).

Middle East & Africa Venture Capital Market Segmentation: Segments in the study include areas by Type, by Industry, and by

Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Middle East & Africa Venture Capital industry.

Country Analysis: Conduct a detailed Country analysis for key areas such as Saudi Arabia, UAE, Egypt, South Africa, Turkey, Israel, and the Rest of the Middle East & Africa.

Company Profiles & Growth Strategies: Company profiles of the Middle East & Africa Venture Capital market and the growth strategies adopted by the market players to sustain the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the Middle East & Africa Venture Capital market’s current market size and growth potential?

The Middle East & Africa Venture Capital market was valued at 3,800 million in 2024 and is expected to grow at a CAGR of 9.50% during the forecast period (2025-2033).

Q2: Which segment has the largest share of the Middle East & Africa Venture Capital market by Type?

The hegemony of the local investor segment is indicative of the growing influence of sovereign wealth funds, government-sponsored vehicles, family offices, and regional corporates capable of injecting patient capital and successively organizing co-investment.

Q3: What are the driving factors for the growth of the Middle East & Africa Venture Capital market?

• State-backed capital & economic-diversification agendas: Government-backed funds, national transformation programs, and diversification priorities are accelerating venture activity by crowding in private capital and expanding pipelines in strategic sectors.

• Digital adoption and young, mobile-first consumers: Rapid digitization and a large, tech-savvy population are boosting demand for digital services, enabling faster user acquisition and strengthening the region’s startup formation and scaling momentum.

Q4: What are the emerging technologies and trends in the Middle East & Africa Venture Capital market?

• Regulatory modernization in key hubs: Reforms around licensing, foreign ownership, fintech enablement, and digital trust frameworks are reducing friction, improving investor confidence, and supporting faster time-to-market for startups.

• Structured funding and sector concentration: Capital is increasingly routed through organized programs (accelerators, matched co-investment, and growth funds), while funding concentrates in sectors with clearer monetization and scale potential, such as fintech, SaaS, logistics, and healthtech.

Q5: What are the key challenges in the Middle East & Africa Venture Capital market?

• Geopolitical uncertainty: Regional tensions and policy shifts can affect investor sentiment, cross-border expansion plans, and deal timelines, increasing risk premiums and diligence requirements.

• Macro & currency risk in the African region: Inflation, FX volatility, and liquidity constraints can pressure startup costs and valuations, complicate repatriation and exit planning, and raise the bar for resilient unit economics.

Q6: Which country dominates the Middle East & Africa Venture Capital market?

Saudi Arabia dominates the Middle East & Africa venture capital market, supported by Vision 2030 initiatives, government-backed funding, and strong deal flow in fintech, SaaS, logistics, and consumer platforms.

Q7: Who are the key players in the Middle East & Africa Venture Capital market?

Some of the top Venture Capital companies in the Middle East & Africa include:

• Wamda Capital

• Middle East Venture Partners (MEVP)

• Global Ventures

• Partech Partners

• Beco Capital

• Saudi Venture Capital Company (SVC)

• 500 Global

• Phoenician Funds

• Beyond Capital

• Nuwa Capital

Q8: What are the opportunities for companies within the Middle East & Africa Venture Capital market?

• Focus on climate and energy resilience: Rising attention to climate adaptation, water and food security, and energy reliability is opening strong investment pathways in climate tech, efficiency, storage, and resilience-driven solutions.

• Cross-border scale play: Startups that can replicate models across MEA markets—leveraging shared consumer behaviors and underserved demand—are well positioned to unlock larger addressable markets and attract follow-on global capital.

Q9: How are consumer preferences shaping product development in the Middle East & Africa Venture Capital market?

Consumer preferences are pushing MEA startups to build mobile-first, localized products that prioritize convenience, affordability, and trust. Demand for seamless digital payments, faster delivery, and personalized experiences is accelerating product iteration, while stronger expectations around data privacy and reliability influence design and compliance.

Related Reports

Customers who bought this item also bought