- Home

- About Us

- Industry

- Services

- Reading

- Contact Us

Dental Insurance Market: Current Analysis and Forecast (2025-2033)

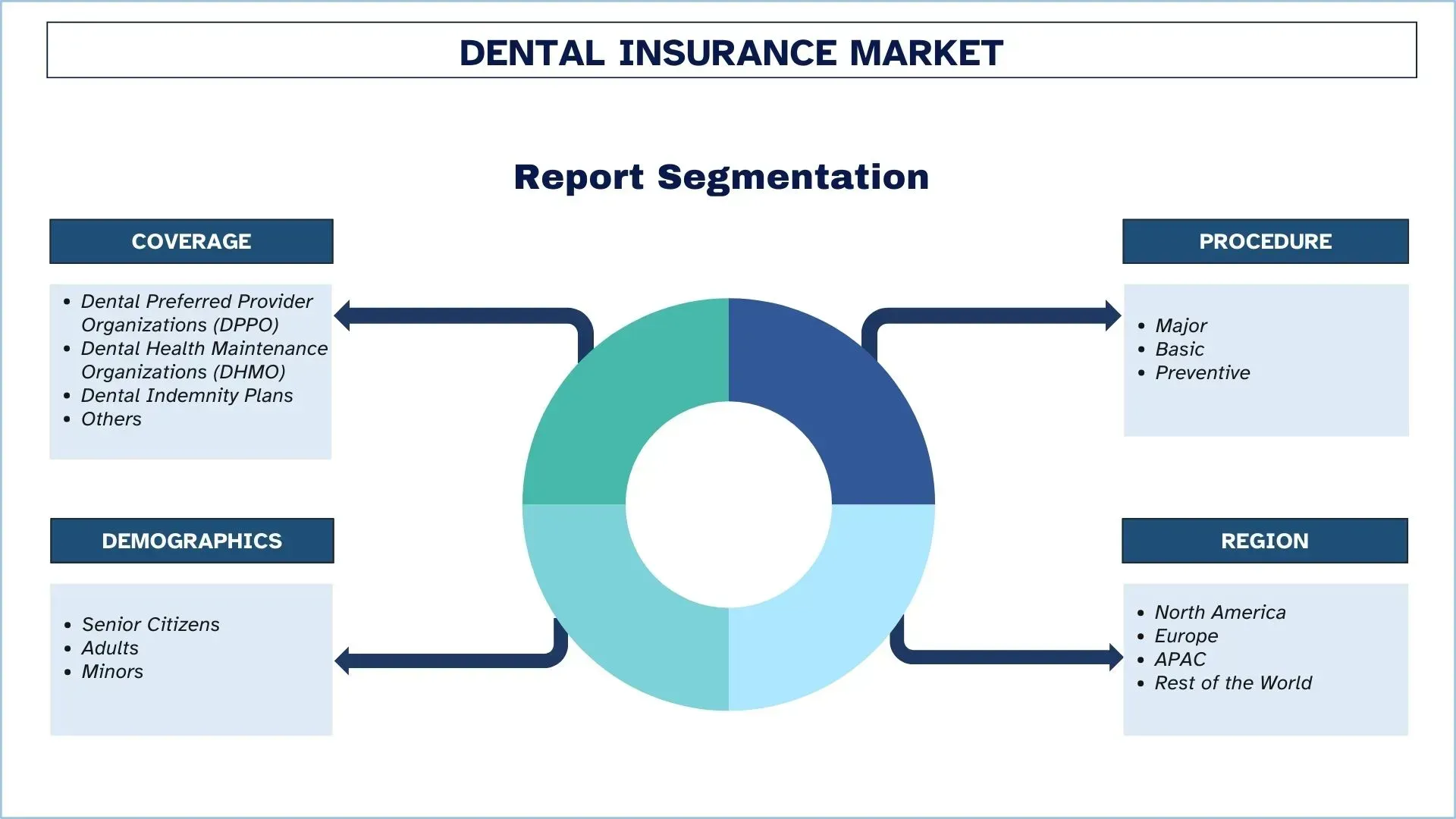

Emphasis on Coverage (Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, and Others); Procedure (Major, Basic, and Preventive); Demographics (Senior Citizens, Adults, and Minors); and Region/Country

Global Dental Insurance Market Size & Forecast

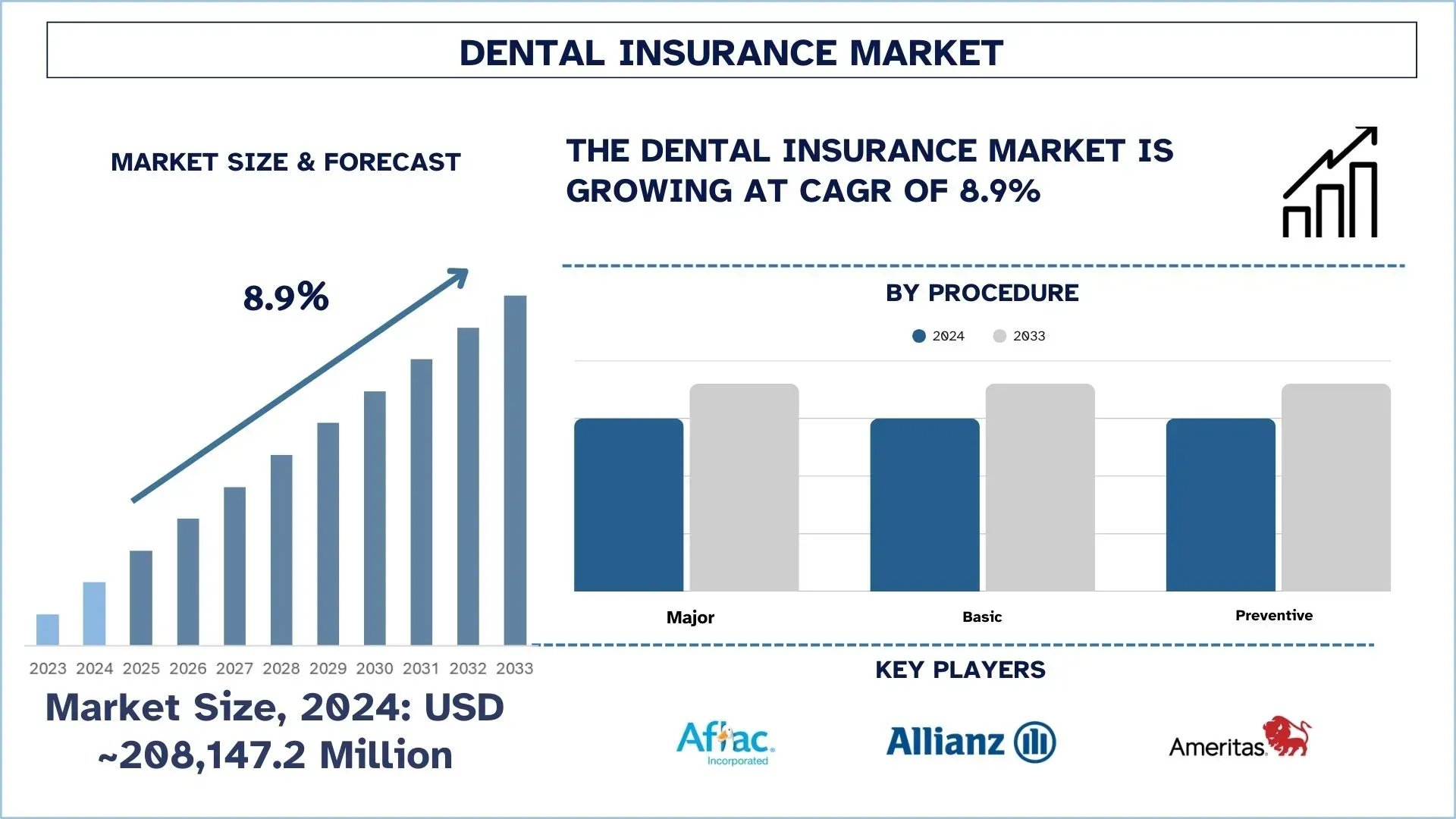

The global Dental Insurance Market was valued at USD 208,147.2 Million in 2024 and is expected to grow to a strong CAGR of around 8.9% during the forecast period (2025-2033F), owing to the rising awareness of oral health and the increasing demand for preventive dental care.

Dental Insurance Market Analysis

The dental insurance business is progressing at a considerable pace due to the awareness regarding the importance of oral hygiene and a rise in dental care costs, and demand for preventive measures. It comprises: DHMO, DPPO, and indemnity; nowadays, DPPO is more popular among people because it is cheap and provides more freedom to choose the right dentist. Programs like the employer-sponsored plans, public health initiatives, and the adoption of digital health services are other ways that are motivating individuals to seek dental insurance coverage.

India and Brazil are expected to be two of the most promising regions that demonstrate a steady growth rate in terms of consumption of dental insurance due to the improving availability of healthcare services, a growing middle-class population, and the rising consciousness about dental health. Insurance development and cooperation with private dental care providers are also contributing towards the growth of this sphere in these areas. That is why these countries remain attractive targets for penetration into the field of dental insurance, which is still in a development phase as for their population’s access to high-quality health care services.

Global Dental Insurance Market Trends

This section discusses the key market trends that are influencing the various segments of the global Dental Insurance market, as found by our team of research experts.

Integration of Artificial Intelligence (AI)

AI continues to grow in its place in the dental insurance market at a very rapid rate. The innovations in AI technology are specifically enabling more streamlined handling of claims and diagnostics, as well as better identification of any occurring fraud. Soft cognitive services are being used by insurers to enable them to make claims regarding speeding up the process of arriving at a decision, and increasing the accuracy of such a decision. Another of its applications is employed for medical insurance by analyzing data to determine a client’s dental health and suggest preventative measures. The members explain that in daily dentistry, AI helps in diagnosis, for instance, in the analysis of X-rays to check for possible cavities or signs of gum diseases that need referral for intervention. These increased efficiencies through the integration of AI into both the insurance industry and the clinical realm are enabling insurance plans to be less expensive while also creating ease in dental access for all parties.

Rise of Teledentistry

The practice of teledentistry is currently slowly picking up in the dental insurance market and is a common feature in today’s world due to the advancement in information technology and the high costs of going physically to a dental practitioner. With the help of the Internet, patients can contact a dentist online and get a consultation on further treatment, diagnostics, and prescriptions. This serves a significant role, especially in areas not served by a dentist or regions in the countryside. The follow-up appointment is also done through teledentistry to ensure the patient does not travel a long distance before they are attended to. The growing number of dental insurances covering teledentistry means that it is now viable for people to embrace this type of service. It has also been predicted that the use of teledentistry will increase in the near future since it serves as a supplement or augmentation to the traditional approaches to care delivery in oral health.

Focus on Preventive Care

Today, another important area in dental insurance is undergoing evolution, which implies that it is now more focused on preventive services, including examination, prophylactic treatment, and screening for diseases later on. This trend is attributed to the shift in perceptions that it is possible to save cash in the long run and avoid intricate operations, for example, root canal treatments or extractions. Many insurers currently allow full or low deductibles for preventive services with a view to ensuring that individuals visit the dentist regularly. This not only makes a long-term economic sense for insurance companies as well as for patients, but it has also proven to be beneficial in most overall health-related matters, such as linking dental health with such diseases as heart disease, diabetes, and stroke. Hence, the dental insurance business is about controlling the incidence and prevalence of diseases with the thought that higher levels of proactive care put the cost of health care under check while improving the lives of its members.

Consolidation through Mergers and Acquisitions

The overall development and growth in the dental insurance industry show increased action by large insurance firms, where they acquire small dental insurers and DSOs to consolidate a stronger market base and offer services. An instance of this is the acquisition of DentaQuest by Sun Life Financial, which is one of the largest dental benefit providers in the United States, to increase the firm’s scope of specialization in dental insurance. Such acquisitions and mergers make it possible for companies to maximize on the concept of economies of scale and at the same time, make it possible for the companies to offer more services to their customers. Moreover, through consolidations, such resources and technologies get improved by bringing them together and increasing innovation in areas of claims processing, customer services, and care delivery. This is because competition is anticipated to rise and, therefore, the appraisal of organizations to reposition themselves in the current markets.

Dental Insurance Industry Segmentation

This section provides an analysis of the key trends in each segment of the global Dental Insurance market report, along with forecasts at the global, regional, and country levels for 2025-2033.

Dental Preferred Provider Organizations (DPPO) Category Dominates the Dental Insurance Market.

Based on Coverage, the market is bifurcated into Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, and Others. Among these, the DPPO segment is leading the market. The main force behind DPPO is the increasing need for accessible and reasonable dental services. DPPO contracting comes with lower premiums for its members when they choose dentists within the DPPO panel, while still giving the flexibility to attend non-contracted dentists, which goes well with the consumer’s interests for insurance packages that make a distinction between in and out-of-network providers. Also, the shifting of attention toward disease control and decreased individual usage of dental care plans provided by employers that commonly interconnect with DPPO also drives the growth of DPPO.

The Preventive Market Category Dominates the Dental Insurance Market.

Based on the Procedure, the market is segmented into Major, Basic, and Preventive. Among these, Preventive is the largest contributor to the Dental Insurance industry. The primary factor driving the growth of the preventive segment of the dental insurance market is the clients’ focus on timely diagnosis of dental problems and regular check-ups to avoid the need for extensive dental treatments and their costs. Avoidable care has been defined as cleanings, exams, and X-rays that insurers, healthcare providers, and governments are encouraging to keep the population healthy by preventing expensive procedures such as root canals or surgery. Moreover, it is revealed that many of the dental plans come with full coverage or low co-pay for preventive care, which makes dental visits more frequent. This proves to be beneficial both to the target patients and insurers because it allows for the early identification of risk factors and minimization of potential claims.

APAC is expected to grow at a considerable rate during the forecast period.

The APAC dental insurance market is a region in pre-development due to the rising awareness of oral care, a growing middle-class populace, and corresponding new spending motives from the government to strengthen the existing healthcare system. The horizontal increase in preventive care and dental hygiene consciousness in many countries of the region, including India, China, Japan, and South Korea, has extended the demand for dental insurance products. The rise in disposable income and modification of the pattern of consuming food have led to the rise of dental ailments; this is making people seek insurance policies to cover dental procedures. However, the growth of insurance is attributed to urbanization, lifestyle, and changes that are working towards the increase of cosmetic dentistry, hence an increase in insurance uptake. The market is also growing through advancements in technology and the adoption of technology in insurance services, where customers can enroll, process claims, and engage with the insurer electronically. In the APAC region, the dynamics of the demographic factors, increasing cost of healthcare facilities, and policy changes are pressuring the growth of the dental insurance market at a very fast pace.

China held a dominant share of the APAC Dental Insurance market in 2024

China has been evidently prominent in the Asia-Pacific dental insurance market, due to the growing middle-class populace, enhancing the awareness of oral hygiene, and governmental schemes to popularise the insurance schemes of the healthcare sector. Increased consumption, coupled with further urbanization and economic development within the country, has contributed to increased demand for private and public dental insurance in the metropolitan urban areas. Also, due to the recent focus on improving the state's healthcare infrastructure, several insurance companies in China have both native and international entities that are keen on investing in the market. Thus, increased volatility in preventive oral health and better availability of dental services will keep China as one of the key growth drivers in the APAC dental insurance market in the future.

Dental Insurance Competitive Landscape

The global Dental Insurance market is competitive, with several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, and mergers and acquisitions.

Top Dental Insurance Companies

Some of the major players in the market are Aflac Inc., Allianz SE, Ameritas Life Insurance Corp., Axa S.A., HDFC ERGO General Insurance, Cigna, Delta Dental Plans Association, MetLife Inc., United Concordia (Highmark Inc.), and United HealthCare Services Inc.

Recent Developments in the Dental Insurance Market

In June 2022, Sun Life Financial Inc. (TSX: SLF) (NYSE: SLF), through its U.S. division, successfully completed the acquisition of DentaQuest, the second-largest dental benefits provider in the United States by membership. The acquisition was made from CareQuest Institute for Oral Health, a U.S.-based nonprofit organization, along with Centerbridge Partners, L.P., a private investment management firm, and minority shareholder.

Global Dental Insurance Market Report Coverage

Report Attribute | Details |

Base year | 2024 |

Forecast period | 2025-2033 |

Growth momentum | Accelerate at a CAGR of 8.9% |

Market size 2024 | USD 208,147.2 Million |

Regional analysis | North America, Europe, APAC, Rest of the World |

Major contributing region | APAC is expected to dominate the market during the forecast period. |

Key countries covered | U.S., Canada, Germany, U.K., Spain, Italy, France, China, Japan, and India |

Companies profiled | Aflac Inc., Allianz SE, Ameritas Life Insurance Corp., Axa S.A., HDFC ERGO General Insurance, Cigna, Delta Dental Plans Association, MetLife Inc., United Concordia (Highmark Inc.), and United HealthCare Services Inc. |

Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Demand and Supply Side Analysis; Competitive Landscape; Company Profiling |

Segments Covered | By Coverage; By Procedure; By Demographics; By Region/Country |

Reasons to Buy Dental Insurance Market Report:

The study includes market sizing and forecasting analysis confirmed by authenticated key industry experts.

The report briefly reviews overall industry performance at a glance.

The report covers an in-depth analysis of prominent industry peers, primarily focusing on key business financials, type portfolios, expansion strategies, and recent developments.

Detailed examination of drivers, restraints, key trends, and opportunities prevailing in the industry.

The study comprehensively covers the market across different segments.

Deep dive regional-level analysis of the industry.

Customization Options:

The global Dental Insurance Market can further be customized as per the requirements or any other market segment. Besides this, UnivDatos understands that you may have your own business needs, hence feel free to contact us to get a report that completely suits your requirements.

Table of Content

Research Methodology for the Global Dental Insurance Market Analysis (2023-2033)

We analyzed the historical market, estimated the current market, and forecasted the future market of the global Dental Insurance market to assess its application in major regions worldwide. We conducted exhaustive secondary research to gather historical market data and estimate the current market size. To validate these insights, we carefully reviewed numerous findings and assumptions. Additionally, we conducted in-depth primary interviews with industry experts across the Dental Insurance value chain. After validating market figures through these interviews, we used both top-down and bottom-up approaches to forecast the overall market size. We then employed market breakdown and data triangulation methods to estimate and analyze the market size of industry segments and sub-segments.

Market Engineering

We employed the data triangulation technique to finalize the overall market estimation and derive precise statistical numbers for each segment and sub-segment of the global Dental Insurance market. We split the data into several segments and sub-segments by analyzing various parameters and trends, including Coverage, Procedure, Demographics, and regions within the global Dental Insurance market.

The Main Objective of the Global Dental Insurance Market Study

The study identifies current and future trends in the global Dental Insurance market, providing strategic insights for investors. It highlights regional market attractiveness, enabling industry participants to tap into untapped markets and gain a first-mover advantage. Other quantitative goals of the studies include:

- Market Size Analysis: Assess the current and forecast market size of the global Dental Insurance market and its segments in terms of value (USD).

- Dental Insurance Market Segmentation: Segments in the study include areas of Coverage, Procedure, Demographics, and regions.

- Regulatory Framework & Value Chain Analysis: Examine the regulatory framework, value chain, customer behavior, and competitive landscape of the Dental Insurance industry.

- Regional Analysis: Conduct a detailed regional analysis for key areas such as Asia Pacific, Europe, North America, and the Rest of the World.

- Company Profiles & Growth Strategies: Company profiles of the Dental Insurance market and the growth strategies adopted by the market players to sustain in the fast-growing market.

Frequently Asked Questions FAQs

Q1: What is the global Dental Insurance market’s current market size and growth potential?

The global Dental Insurance market was valued at USD 208,147.2 million in 2024 and is projected to grow at a robust CAGR of 8.9% from 2025 to 2033, driven by increased emphasis on preventive dental care and rising dental healthcare costs.

Q2: Which segment has the largest share of the global Dental Insurance market by Type?

In 2024, the DPPO (Dental Preferred Provider Organization) segment held the largest market share due to its flexibility in provider choice, cost savings, and widespread adoption across both individuals and employer-sponsored plans.

Q3: What are the driving factors for the growth of the global Dental Insurance market?

Major factors propelling market growth include:

• Rising awareness of oral health and hygiene

• Escalating costs of dental treatments worldwide

• Increased focus on preventive care and early intervention

• Expansion of employer-sponsored dental plans

Q4: What are the emerging technologies and trends in the global Dental Insurance market?

Key innovations and trends include:

• Use of artificial intelligence (AI) for claims processing, fraud detection, and personalized care recommendations

• Growth of teledentistry for remote consultations and rural care access

• 3D printing applications in custom dental prosthetics and aligners

• Personalized insurance plans based on lifestyle and dental history

Q5: What are the key challenges in the global Dental Insurance market?

Critical challenges include:

• High premium costs, limiting accessibility for lower-income groups

• Fragmented regulatory environments across countries and regions

• Limited availability of dental coverage in developing areas

• Complex policy structures, often confusing for end-users

Q6: Which region dominates the global Dental Insurance market?

The Asia-Pacific (APAC) region, with China at the forefront, dominates the market. This is driven by rapid urbanization, increased healthcare spending, and government-backed insurance reforms in countries like India, China, and Japan.

Q7: Who are the key players in the global Dental Insurance market?

Leading companies in the Dental Insurance market include:

• Aflac Inc.

• Allianz SE

• Ameritas Life Insurance Corp.

• Axa S.A.

• HDFC ERGO General Insurance

• Cigna

• Delta Dental Plans Association

• MetLife Inc.

• United Concordia (Highmark Inc.)

• United HealthCare Services Inc.

Q8: What are the investment opportunities in the Dental Insurance market?

Key investment areas include:

• Development of AI-driven platforms for claims automation and fraud prevention

• Expansion of cloud-based insurance administration solutions

• Strategic partnerships with government healthcare schemes

• Launch of affordable, personalized plans in emerging markets

Q9: How are regulations affecting the Dental Insurance market?

Regulations significantly shape this market by influencing:

• Coverage mandates and reimbursement frameworks

• Licensing and compliance standards for private insurers

• Consumer protection policies, including transparency and grievance redressal

• Cross-border insurance collaboration rules, especially in APAC and Europe

Related Reports

Customers who bought this item also bought